FLASH FRIDAY is a weekly content series looking at the past, present and future of capital markets trading and technology. FLASH FRIDAY is sponsored by Instinet, a Nomura company.

In 1998, Traders featured an article on the eight U.S. stock exchanges. Fast-forward 23 years and there are 16 exchanges competing for order flow — five owned by NYSE, four owned by Cboe Global Markets, three by Nasdaq, one by IEX, as well as LTSE, MEMX and MIAX PEARL.

The last three exchanges launched in Q3 2020: the Long-Term Stock Exchange (LTSE), the Members Exchange (MEMX) and the Miami Pearl Equities Exchange, with each of the three having a different focus.

In addition, this week, 24 Exchange, filed key portions of a Form 1 application in draft form with the U.S. Securities and Exchange Commission (SEC) for a license to operate a national securities exchange. If approved, in 2022 there will be 17 stock exchanges. New exchanges can add value to the market, but also add complexity. So, do we really need that many? And how do they each stay competitive?

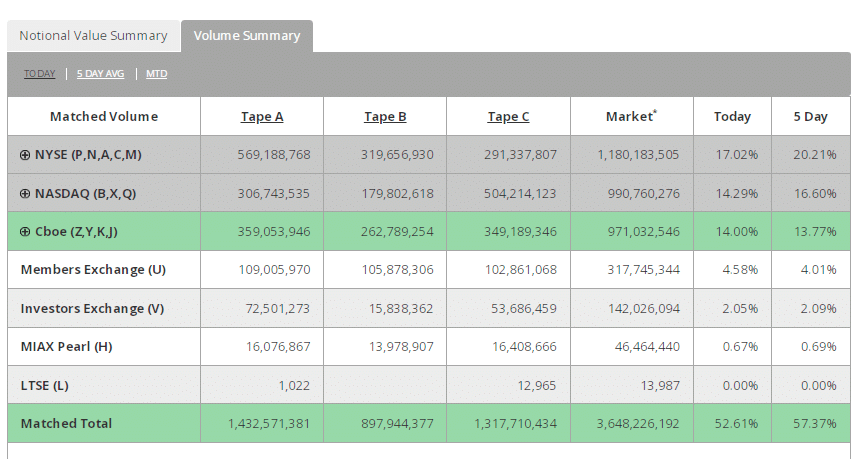

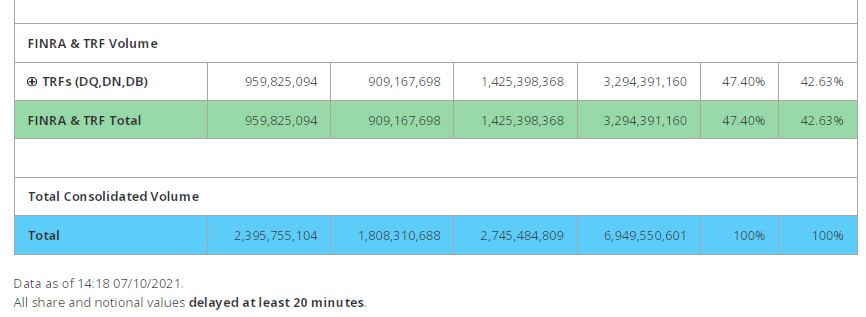

U.S. Equities Market Volume Summary

Market participants on the buy side and sell side generally aren’t fans of the ongoing expansion of the exchange sector, as each new entrant adds connectivity costs and operational complexity, and opportunities for differentiation and innovation diminish with each new entrant.

But exchange operators say their new venues add value.

Andy Nybo, Senior Vice President, Chief Communications Officer at MIAX Exchange Group, said that competition is always healthy in markets: “Competition is very healthy. It results in innovation and in new solutions.”

When there are 16 exchanges competing for order flow, you distinguish yourself by customer service, by the type of technology you provide, as well as liquidity and customer experience that you can offer to your membership and to your participants, he said.

“We’re at a point in time, where there is intense competition: the trading community has access to incredible technology, access to a broad range of liquidity and a lot of that’s been enabled by continued advancements in technology at the exchange level,” he said.

Key to success

To stay competitive, exchanges need to have liquidity, superior client service and a superior, stable technology environment. “It’s really all about technology. It’s all about liquidity. It’s all about client service,” Nybo said.

“Building liquidity is a process, you can’t just turn on a switch and create liquidity overnight,” he said.

He added that there are always fee pressures, and the challenge is to balance the level of fees that the exchange charges its membership, against the services it provides and with the ultimate goal of building liquidity.

In 2020, Miami International Holdings, which operates three options exchanges, launched MIAX Pearl Equities. “It was always our plans to enter the US equity markets,” said Nybo.

“There are synergies between having a listed option platform as well as an equity platform that we can offer to clients,” he said.

In U.S. equities, MIAX Pearl Equities executed 1,379,358,616 shares in September 2021, a monthly volume record and an increase of 78.4% from August 2021. The September 2021 total also represented a market share record of 0.62%.

It’s a competitive marketplace, commented Adam Inzirillo, Head of North American Equities at Cboe Global Markets. However, he noted that notional market share for Cboe has remained stable.

“One of the things that we continue to pride ourselves on is our product innovation,” he said.

Cboe launched several new trading features and functionalities over the course of the last 18 to 24 months to further enhance market participants’ trading outcomes on its exchanges. This includes Cboe’s Quote Depletion Protection (QDP) functionality, which Inzirillo said allows brokers and their institutional clients to interact with passive, non-displayed liquidity while mitigating against adverse selection. In addition, with block-sized liquidity increasingly executed off-exchange, Cboe will be offering Periodic Auctions to provide an on-exchange alternative for participants to trade in size and access immediate liquidity.

Cboe operates four stock exchanges in the U.S. (BZX Exchange, BYX Exchange, EDGA Exchange and EDGX Exchange), accounting for approximately 14% of the total market share. “Across our four exchanges, we offer different pricing models to give participants choice as to when and how they want to use our markets. More broadly, our strategy is to lead with product innovation, grow our market share in the global ETP listings space, attract non-marketable retail flow, and cater to institutional participants with innovative features such as QDP and Periodic Auctions.”

According to Adrian Griffiths, Head of Market Structure at MEMX, competition is key to driving efficient markets and benefits investors. The focus has to be on the unique value proposition for each of the markets, he said.

Just over a year old, MEMX in its first year of operation grew to be the largest independent exchange with the sixth-largest market share of the 16 U.S. equity exchanges.

“We’re providing a unique value to the marketplace, and certainly think that’s why we’ve gotten support from members and have been able to grow.”

Griffiths said that competition, innovation and regulation are important to the evolution of stock exchanges. MEMX is trying to bring competition to the marketplace and is also focused on innovation, just announcing that it will deliver real-time equities pricing data to the Pyth network.

“From the regulatory perspective, our big push has been to advocate for things that we think fundamentally make public markets stronger, are good for our members and for the broader investment community,” he said.

Going forward

Nybo expects continued focus on technology and continued focus on providing better service to the industry. Nybo doesn’t see any regulatory pressures, adding that the SEC is always focused on equity markets and equity market structure evolves over time. “We design our services and build our technology to support evolving market structure,” he said.

Inzirillo believes one of the industry issues that the current regulatory administration is evaluating is how off-exchange and on-exchange trading venues co-exist. “I don’t think it’s fair to say we have too many exchanges. You have to look at the whole ecosystem and assess whether the current model makes sense in today’s market structure. I think the regulators are looking at that, and figuring out how to level the playing field,” he said.

In terms of new exchanges Nybo expects more exchanges to launch in the future. Given the attractiveness of the US equity markets, the volume of trading, the amount of market participants and the demand for US equities, there is a potentiality for a new exchange, he said.

Inzirillo added: “We will continue to innovate and launch new products that can create greater economies of scale, while reaching a wider range of customers.”

from WordPress https://ift.tt/3DD7Zuj

via IFTTT

No comments:

Post a Comment